Hiring Managers: A Rare Opportunity to Secure Premier Talent in Insurance & Wealth Management

With salary premiums shrinking, now is the time to strengthen your team for the future.

The best talent in insurance and wealth management is more affordable than it has been in years—but not for long.

The facts are clear. The economy is uncertain. It remains to be seen how widespread layoffs in the public sector will impact the unemployment rate and the economy. However, the threat of a recession means consumers are playing it safe. While we aren’t there yet, two consecutive quarters of negative GDP growth typically indicate a recession. How does this affect the job market in traditionally stable industries like insurance and wealth management? Companies are less likely to negotiate with candidates who are demanding higher salaries to leave their current roles. Moreover, economic uncertainty is forcing companies to reconsider salary premiums. For hiring managers, this is the moment to secure top-tier talent without breaking the budget.

Are We in an Employers’ Job Market?

Market-driven salary offerings are more rigid than before. In 2023 switching jobs could result in a 7.7% increase in salary. Today, the pay gap between those who switch jobs and those who remain in their roles has changed.

As of February 2025, it is now more lucrative to stay in your job (4.4%) than to switch jobs (4.2%). What does that mean for employers, candidates, and the job market? A new model for employment negotiations emerges.

2023 Salary Increase Trends:

- Job switcher:

+7.7% salary increase

- Job stayer: +4.6% salary increase

February 2025:

- Job stayer: +4.4% salary increase

- Job switcher: +4.2% salary increase

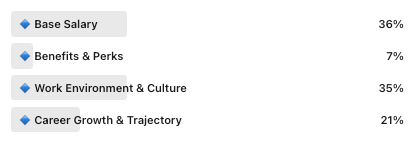

Our recent

poll on LinkedIn reveals that

base salary is only slightly ahead of

work environment and culture when considering a new role. This is an important insight as we head into Q2. Hiring managers who emphasize other areas of opportunity like career trajectory and the options to work remotely or hybrid, can capitalize on the current salary trends.

HR, Meet your Top-Tier Talent

The facts are, economic uncertainty influences the job market. Layoffs for non-essential workers, and minimal salary negotiation for essential roles, are the expectation in an economic downturn.

Take note, hiring managers. Specifically, the insurance and wealth management industries can leverage this trend to attract top-tier talent previously inaccessible due to higher salary expectations.

Some industries are traditionally stable in the face of economic uncertainty. Insurance and wealth management, for example, maintain resilience when inflation hits hard. When other companies are managing layoffs, these industries can effectively compete for high-quality candidates. Companies offering senior finance roles compete for top talent, indicating financial stability and willingness to invest in talent.

What Can Hiring Managers Do?

Act now and leverage this moment to invest in premier talent previously too expensive or unavailable.

Position your organization as the best choice with a total compensation value amidst salary normalization.

Finally, move fast–the window of opportunity to procure premier talent may close sooner than expected.

"This is the least expensive time to acquire new talent in the post COVID era because you don’t have to pay a premium to bring in external talent right now. Traditionally, companies were paying a 20-30% premium for talent, now the market is showing there’s no switching cost to make this talent upgrade from a low performing employee to someone with more skills and experience.”

-Scott Noga, Managing Partner with Lyneer Search Group

Final Thought

Times are always uncertain; however, hiring managers can retain premier talent, even while the wage gap for job seekers and job stayers narrows.

The window could be small. While the timing is right, hiring managers should seize it.

The opportunity to hire top talent at a bargain won’t last forever. The time to act is now—before this window closes.

Who We Are

Lyneer Search Group empowers businesses and professionals in the

insurance and

wealth management industries by delivering tailored executive recruitment solutions that prioritize quality, trust, and long-term success. With a deep industry focus and an extensive network of premier talent, we connect the right people to the right opportunities, driving transformative growth for companies and careers alike

Source: atlantafed.org

FAQ: Hiring Managers – Securing Premier Talent in Insurance & Wealth Management

Why is now the best time to hire top talent in insurance and wealth management?

Right now, salary premiums are shrinking, making top-tier talent more affordable than it has been in years. With economic uncertainty limiting salary negotiations, hiring managers can secure premier candidates without paying a premium. Acting quickly lets you strengthen your team before the market shifts.

How has the job market shifted for job switchers versus job stayers?

As of February 2025, job stayers see an average 4.4% salary increase, compared to 4.2% for job switchers. This is a reversal from 2023, when job switchers enjoyed a 7.7% increase. The shift signals that employers have more leverage in salary negotiations.

How does the economy impact hiring in stable industries like insurance and wealth management?

Economic uncertainty is creating a rare hiring advantage. Layoffs in other industries are making top candidates available, while traditionally stable sectors like insurance and wealth management can recruit without offering steep salary premiums.

What strategies can hiring managers use to attract top-tier talent right now?

Focus on total compensation value beyond base pay. Emphasize career growth opportunities, remote/hybrid flexibility, and company culture. Highlight long-term stability. Acting now ensures you secure talent before salary premiums rise again.

Are we in an employer’s job market in 2025?

Yes. Current salary trends favor employers. Companies are more cautious about negotiating high raises for job switchers, making it the ideal time to hire skilled professionals without breaking the budget.

How long will this opportunity last?

The window is temporary. As the economy stabilizes, salary expectations will increase again. Hiring managers who move quickly can secure premier talent at a lower cost while the opportunity lasts.

How can Lyneer Search Group help me hire top talent?

Lyneer Search Group connects insurance and wealth management companies with premier executive talent. Our tailored recruitment strategies are built for long-term success, helping you secure the right people to drive growth in uncertain times.