Middle Market Insurance Expansion Report 2025 | Lyneer Search Group

Executive Hiring Trends Driving U.S. Insurance Market Growth in Charlotte, Tampa & Chicago

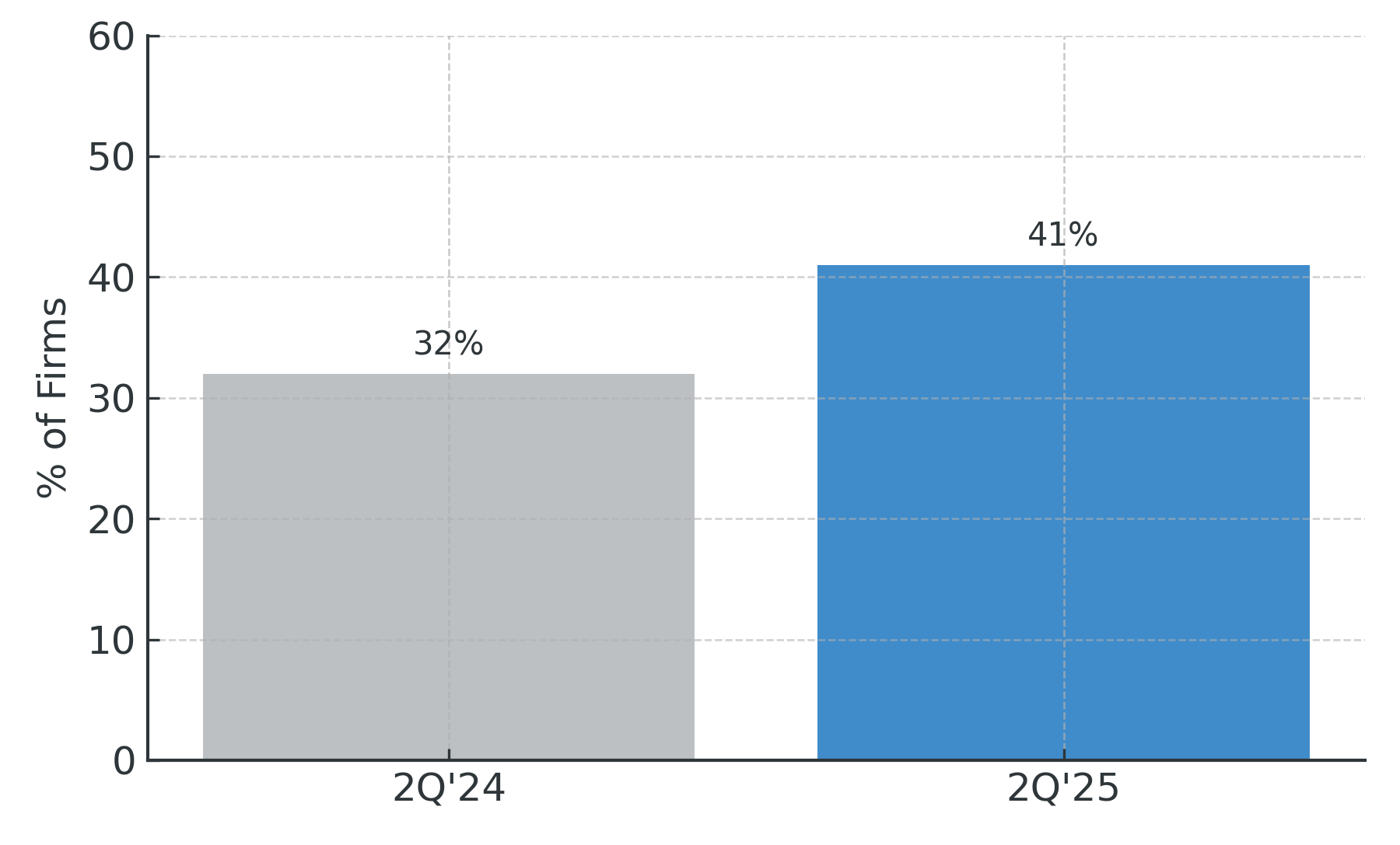

The U.S. middle-market insurance sector entered 2025 amid tempered optimism. According to the National Center for the Middle Market (NCMM), companies reported 10.7 % average revenue growth and 7.3 % employment growth at mid-year 2025 — a moderation from the rapid expansion seen in 2024. Roughly 41 % of firms expanded into new domestic markets, while 63 % anticipate revenue growth through 2026. Within the insurance industry, carriers and MGAs are refocusing on regional expansion as a path to diversification and margin stability. Success in these markets depends on executive leadership—particularly in finance, accounting, underwriting, and actuarial functions—capable of translating analytics, compliance, and profitability into sustainable growth.

Lyneer Search Group’s 2025 Q4 analysis examines how insurers expanding into Charlotte, Tampa, and Chicago are approaching leadership hiring and what the 2026 outlook suggests for compensation and executive-search demand.

Regional Insights

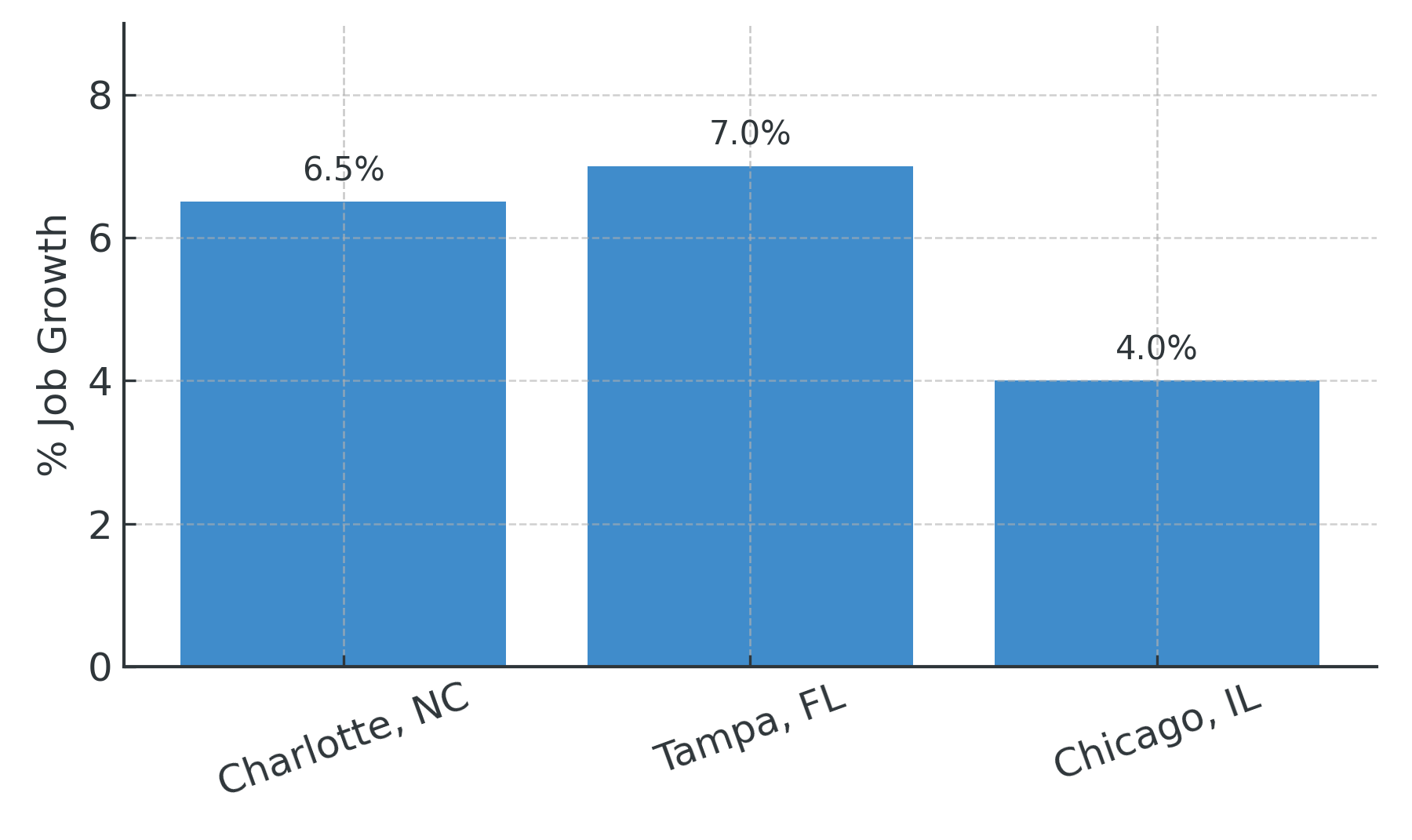

Charlotte, North Carolina

Charlotte’s insurance and financial-services sector expanded by roughly

11 % YoY in 2025, outpacing broader Southeastern averages. Carriers continue consolidating finance and data-analytics operations here to leverage the city’s deep bench of FP&A and controllership talent.

Demand remains high for

CFOs, Controllers, and Actuarial Analytics Leads, with compensation up about

6 % YoY.

2026 Outlook: continued steady growth as insurers modernize reporting platforms and build hybrid finance-technology roles.

Tampa, Florida

Tampa’s insurance ecosystem grew approximately 9 % in 2025, led by P&C and reinsurance expansion along the Gulf Coast. As carriers strengthen coastal exposure management and claims automation, the city is seeing rising demand for Chief Underwriters, FP&A Directors, and Regulatory Controllers.

2026 Outlook: hiring expected to rise another

5 – 7 %, particularly for actuarial pricing and risk-modeling leadership.

Chicago, Illinois

Chicago’s middle-market carriers recorded about 10 % revenue growth and 8 % employment gains in 2025. Executive recruiting here emphasizes strategic-finance and risk-leadership roles as insurers integrate insurtech partnerships and alternative-investment strategies.

2026 Outlook: moderate hiring with

4 % wage inflation, driven by competition from fintech and advisory firms.

Expanded into New Domestic Markets — Middle Market (NCMM)

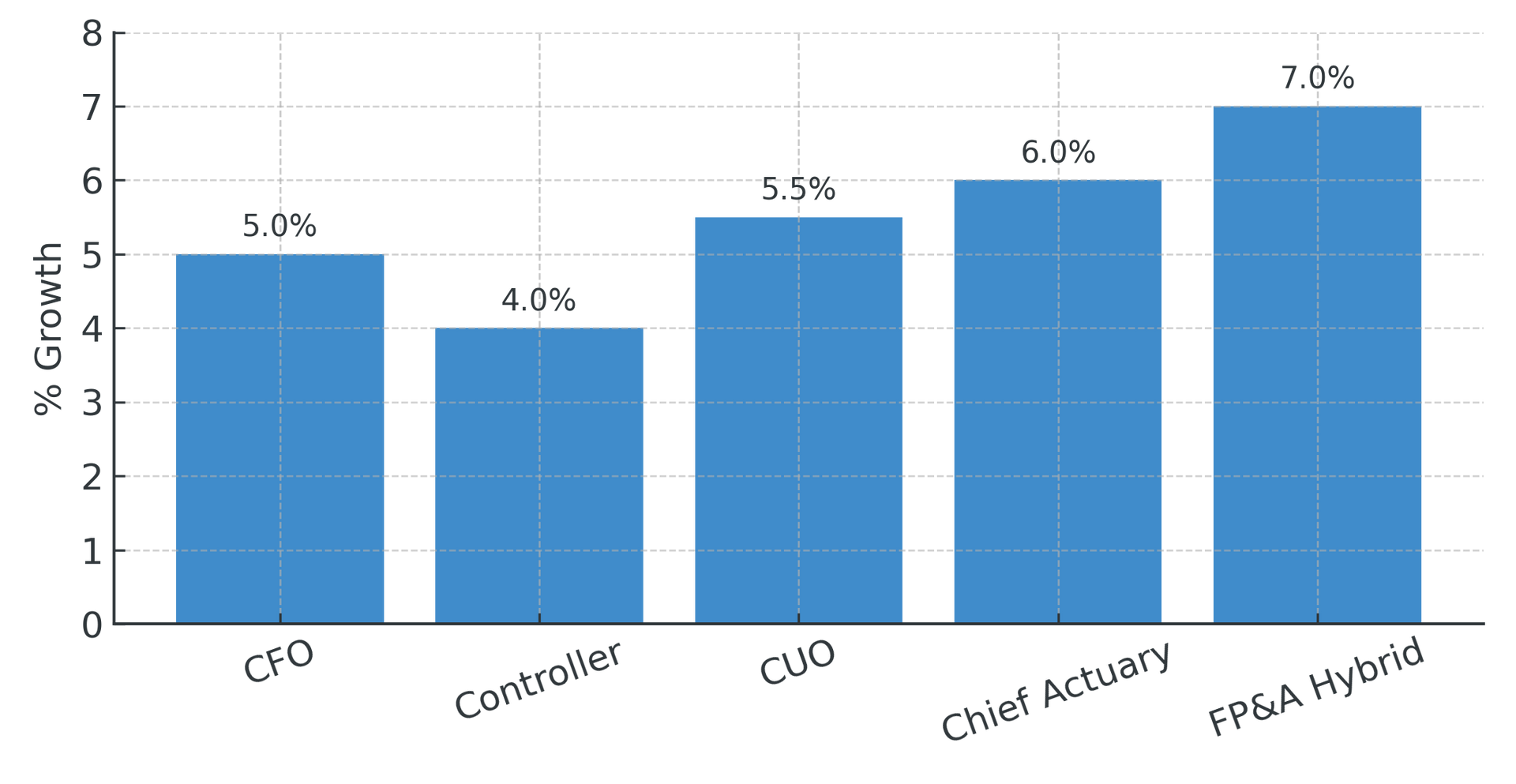

Executive Role & Compensation Benchmarks

(Total Cash Compensation = Base + Bonus; rounded $000s)

| Role | 25th % | 50th % (Median) | 75th % | 90th % | Top Decile |

|---|---|---|---|---|---|

| Chief Financial Officer | $225 K | $295 K | $360 K | $430 K | $500 K |

| Controller | $160 K | $205 K | $250 K | $295 K | $340 K |

| Chief Underwriting Officer | $210 K | $260 K | $315 K | $370 K | $420 K |

| Chief Actuary | $240 K | $310 K | $380 K | $450 K | $525 K |

| FP&A / Finance-Analytics Hybrid | $175 K | $225 K | $275 K | $320 K | $365 K |

Regional Highlights

- Charlotte salaries average 4 % below Chicago, 2 % below Tampa.

- Tampa posts the fastest actuarial pay growth (+7 % YoY).

- Hybrid FP&A + Data roles increased 13 % in job postings since 2024.

Hiring & Compensation Growth by Role Function

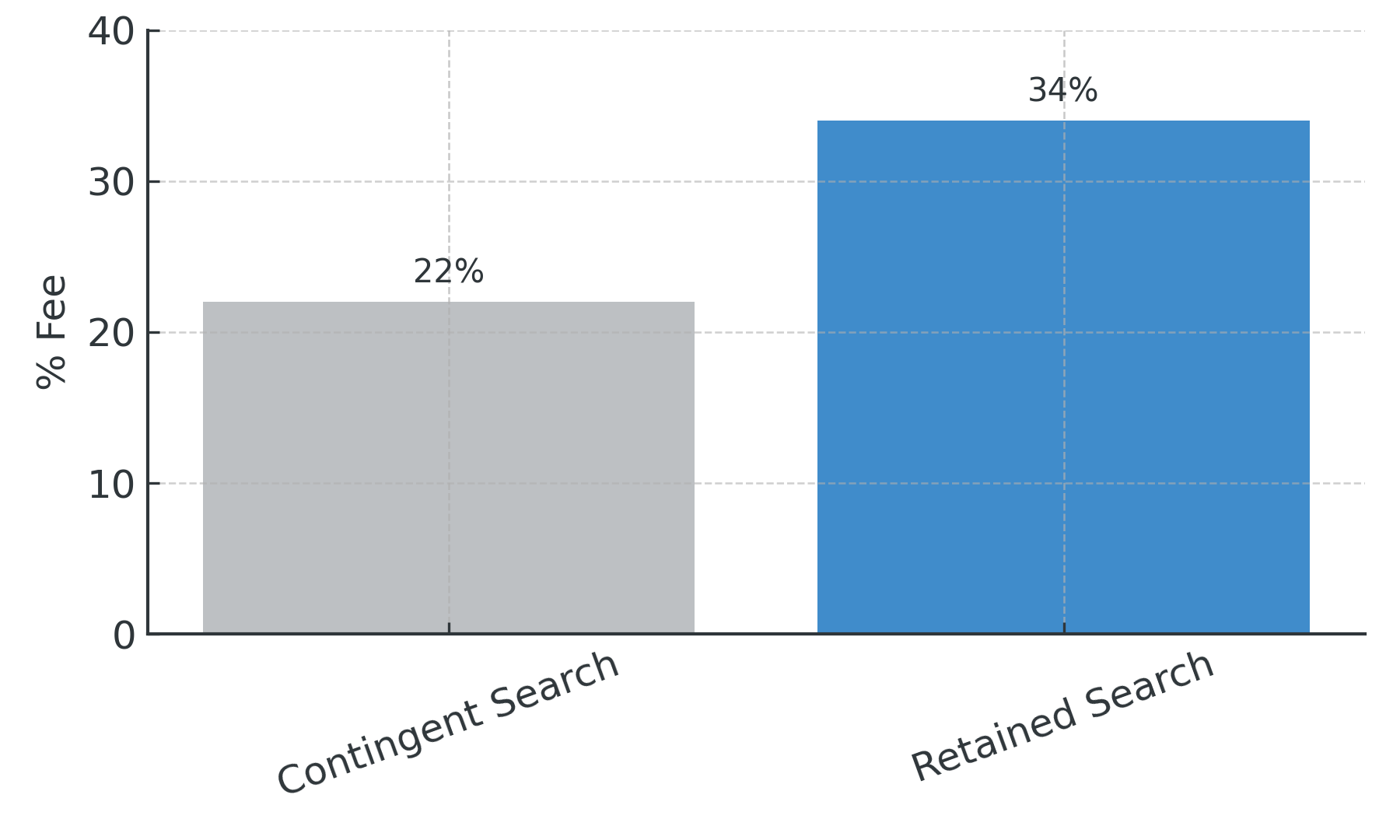

Hiring & Executive Search Benchmarks

| Metric | Benchmark (2025) | Notes |

|---|---|---|

| Average time-to-fill (C-suite) | 120 – 150 days | Multi-stakeholder approvals |

| Time-to-fill (Sr Finance roles) | 90 – 120 days | Leading Recruiting Firm avg ≈ 123 days |

| Retained search fee | 30 – 38 % of 1st-year cash comp | AESC / Hunt Scanlon range |

| Contingent search fee | 20 – 25 % | Usually non-executive roles |

| Cross-market placements | +15 – 20 % longer cycle | Licensing and relocation time |

Insights

- 74 % of AESC-surveyed clients choose retained search for C-suite and multi-market mandates.

- Middle-market insurers expanding into new metros increasingly require finance + actuarial dual expertise.

- Hybrid leadership roles (e.g., CFO ↔ Chief Data Officer) now represent roughly 1 in 6 executive searches.

Projected Job Growth Charlotte, Tampa, Chicago

Executive Search Fee Benchmarks (as % of 1st-Year Cash Comp)

Conclusion

While national growth slowed modestly in 2025, middle-market insurers remain expansion-focused—and their success hinges on the depth of leadership talent they attract. Firms that integrate financial governance, actuarial analytics, and operational insight will capture efficiency and growth as the market normalizes in 2026.

Partner with Lyneer Search Group to identify, engage, and place the executive talent that will anchor your next market expansion.

Contact Us

About Lyneer

Lyneer Search Group is a premier executive-search firm specializing in finance, accounting, underwriting, and actuarial leadership for the insurance and financial-services sectors. With national reach and data-driven precision, Lyneer connects growth-minded insurers with transformative leaders who drive expansion and long-term value.

Sources

- National Center for the Middle Market, Mid-Year 2025 Middle Market Indicator Report

- U.S. Bureau of Labor Statistics (OES and QCEW 2024–2025)

- ADP Research Institute Employment Report (2024–2025)

- AESC Client Perspective Survey 2025

- Hunt Scanlon Media, State of Executive Search 2025

- Executive Recruiting Firms, Executive Search Performance Benchmarks