AI and Entry-Level Finance Hiring: An Early Warning

AI is reshaping finance hiring. And It's hitting entry-level talent first.

Artificial Intelligence isn't coming—it’s already here, and it’s rewriting the rules of who gets hired in finance.

Microsoft’s Bill Gates predicts a world where humans “aren’t needed for most things” within a decade. That sounds far-off—until you look at what’s already happening in financial hiring.

A new Stanford study confirms it: AI is quietly reshaping the workforce. And the earliest casualties? Entry-level professionals in finance and accounting.

What the research shows

The study—Canaries in the Coal Mine? Six Facts about the Recent Employment Effects of Artificial Intelligence—analyzed payroll data from millions of U.S. workers.

The conclusion is stark: firms using AI tools are slowing down hiring of younger employees, especially those aged 22–25. Meanwhile, senior professionals are not only holding steady but in many cases seeing job growth.

This isn’t a temporary blip. It’s a trend that started in late 2022, right as tools like ChatGPT began changing how teams work.

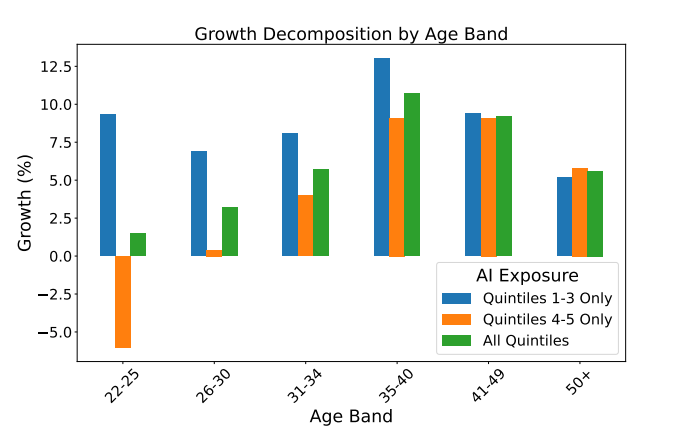

The graphic Fig 5 from the study explains that:

For each age group, employment growth from late 2022 to July 2025 was 6-13% for the lowest three AI exposure quintiles, with no clear ordering in employment growth by age. In contrast, for the highest two exposure quintiles employment for 22-25 year olds declined by 6% between late 2022 and July 2025, while employment for workers aged 35-49 grew by over 9%. These results show that declining employ- ment in AI-exposed jobs is driving tepid overall employment growth for workers between the ages of 22 and 25."

When the values for an indicator are divided into five equal groups, each grouping is a known as a quintile. Each quintile represents 1/5 or 20% of the range of values for the indicator. The first quintile represents the lowest 1/5 of values from 0-20% of the range.

Why Entry-Level Roles Are Being Replaced First

AI thrives on textbook knowledge—the kind of skills you learn in school or early in your career. Tasks like reconciliations, compliance checks, or variance analysis? AI can handle those, often faster and more accurately.

But what AI can’t replace is experience: strategic thinking, business judgment, and deep client knowledge. And that’s where older employees maintain their edge.

Six Key Facts for Finance Hiring Managers

- Young talent is at risk

Entry-level employees in AI-heavy roles are being hired less frequently than their experienced peers. - Overall jobs are growing—but not for juniors

Since 2022, hiring for 22–25-year-olds in finance roles dropped 6%, while hiring for older staff rose up to 9%. - Automation cuts; augmentation protects

AI that automates routine tasks reduces junior hiring. But when AI supports complex work, headcount remains strong. - This trend isn't about the economy

Even after adjusting for interest rates and cost-cutting, AI itself emerges as the clear cause. - Pay isn't falling—just the number of hires

Salaries remain stable, but firms are opting to do more with fewer entry-level employees. - It’s a new shift, not a slow evolution

The hiring gap began around the same time as the generative AI boom. It’s not visible in older data.

What It Means for Hiring Teams in Finance & Insurance

The need to address this pipeline challenge is has arrived. If entry-level talent dries up, your future leadership bench weakens. For firms in insurance, and wealth management, that’s a risk with long-term consequences.

So what can hiring leaders do today to balance AI efficiency with sustainable workforce growth?

Redefine early-career roles

Instead of staffing juniors exclusively on routine reconciliations, compliance checks, or variance analysis, recast entry-level positions as “learning labs.” Use them to build the skills that AI can’t replicate: strategic thinking, pattern recognition, and relationship-building.

Prioritize human skills development

AI handles the technical grind. That means your junior staff should be trained where AI falls short—judgment, ethical reasoning, negotiation, and client trust. These are the qualities that move employees from “operators” to “future leaders.”

Treat AI as a talent multiplier

The firms that win in 2025 will treat AI as a co-pilot, not a replacement. Use AI to speed up data-heavy tasks so that early-career staff can focus on interpretation, storytelling, and advising. This dual focus makes work more engaging and accelerates employee development.

Accelerate knowledge transfer through mentorship

Institutional knowledge is your real competitive advantage. Pair juniors with seasoned mentors to fast-track tacit knowledge transfer. Structured mentoring ensures younger staff don’t just learn the “what,” but the “why” behind decisions—a skill AI cannot teach.

Build career pathways with intention

If junior roles vanish, so does the leadership pipeline. Protect it by ensuring every early-career hire has a clear growth trajectory—from analyst to advisor, from controller to CFO. This not only secures your future leadership but also helps attract ambitious talent who want more than transactional work.

Bottom Line: AI can optimize your operations today, but without intentional hiring strategies, it risks hollowing out tomorrow’s leadership. Forward-looking firms will design entry-level roles that grow human capital alongside technological capability.

Automation vs. Augmentation: Choose Wisely

Automation is great for cutting costs. But augmentation? That’s how you grow smart.

With augmentation, AI acts like a copilot—analyzing faster, personalizing deeper, and helping humans make sharper decisions. It's about building synergy between people and machines.

Lyneer: Where AI Meets Human Expertise

From top-tier insurance carriers to wealth management firms, Lyneer partners with clients who expect more than just resumes. We combine AI-powered search with deep human expertise to deliver finance talent that fits.

When the stakes are high, we deliver clarity, speed, and results—because hiring isn’t just about filling seats. It’s about building your future.

Let's talk talent

FAQ: AI & Entry-level Finance Hiring

How is AI affecting finance and accounting jobs in insurance and wealth management?

AI is reducing demand for entry-level roles that involve routine reporting, reconciliations, and basic analysis. Senior finance staff are less affected because their work depends more on experience and judgment.

Are overall finance jobs shrinking?

No. Total finance and accounting jobs in insurance and wealth management remain strong. The slowdown is concentrated in early career roles.

What types of finance tasks are most at risk from AI?

Repetitive tasks like reconciliations, variance checks, and simple forecasting. These are easier for AI to automate than strategic or client-facing work.

How can hiring managers adapt to AI in finance and accounting roles?

Design junior roles around skills AI cannot replace, such as communication, problem-solving, and regulatory judgment. Pair young hires with mentors to build tacit knowledge quickly.