Why Finance and Insurance Hiring Remain Resilient—Even When National Job Growth Slows

New Jobs Data Paints a Mixed Picture—But Finance and Insurance Stand Apart

July’s national jobs report showed sluggish momentum: only 73,000 new jobs were added, with earlier months revised sharply downward. On the surface, it suggests a cooling labor market.

But dig deeper, and the story shifts.

In

finance and

insurance, the picture looks very different.

While overall non-farm job growth slowed, finance and insurance sectors showed surprising resilience. These industries not only added jobs—they maintained one of the lowest unemployment rates across all sectors, well below the national average.

That’s no coincidence.

And here’s the nuance: national labor stats often miss the unique dynamics shaping specialized fields. In areas like risk management, regulatory compliance, AI automation, and wealth advisory, demand remains robust. The niche-level data reveals a far more active hiring landscape than the headlines suggest.

Our deep-dive reveals strong hiring activity across roles in financial risk, regulatory reporting, AI-driven automation, and

wealth management—areas that remain essential, even as the macro trend cools.

What Is the Finance and Insurance Sector?

The finance and insurance sector is the engine behind how money moves, risk is managed, and financial systems stay stable. It's made up of businesses that do three main things:

1. Move Money

Banks, lenders, and investment firms raise capital—by accepting deposits or issuing securities—and then lend or invest those funds. This function, known as financial intermediation, connects people and institutions who need money with those who have it. It also transforms that money to better fit timelines, risk levels, and scale.

2. Manage Risk

Insurance companies and annuity providers play a critical role by pooling risk. They collect premiums, grow reserves through investment, and pay out claims. It’s how individuals and businesses protect themselves against the unexpected.

3. Keep the System Running

This includes firms offering essential services like brokerage, asset management, employee benefits administration, and financial advisory. These support systems help ensure that capital markets and financial planning run smoothly.

Government institutions like central banks also belong to this sector. They oversee monetary policy, regulate the money supply, and help maintain financial stability across the economy.

Core Sub-Sectors Within Finance and Insurance

The industry is structured into the following key sub-sectors:

- Monetary Authorities: Central banks and regulators that manage currency and interest rates.

- Credit Intermediation and Related Activities: Traditional banking, lending, and mortgage services.

- Securities, Commodity Contracts, and Other Financial Investments: Investment firms, brokerages, and asset managers.

- Insurance Carriers and Related Activities: Insurers, reinsurers, and insurance agents.

- Funds, Trusts, and Other Financial Vehicles: Mutual funds, pension funds, and investment pools.

Key Highlights for Finance & Insurance Hiring

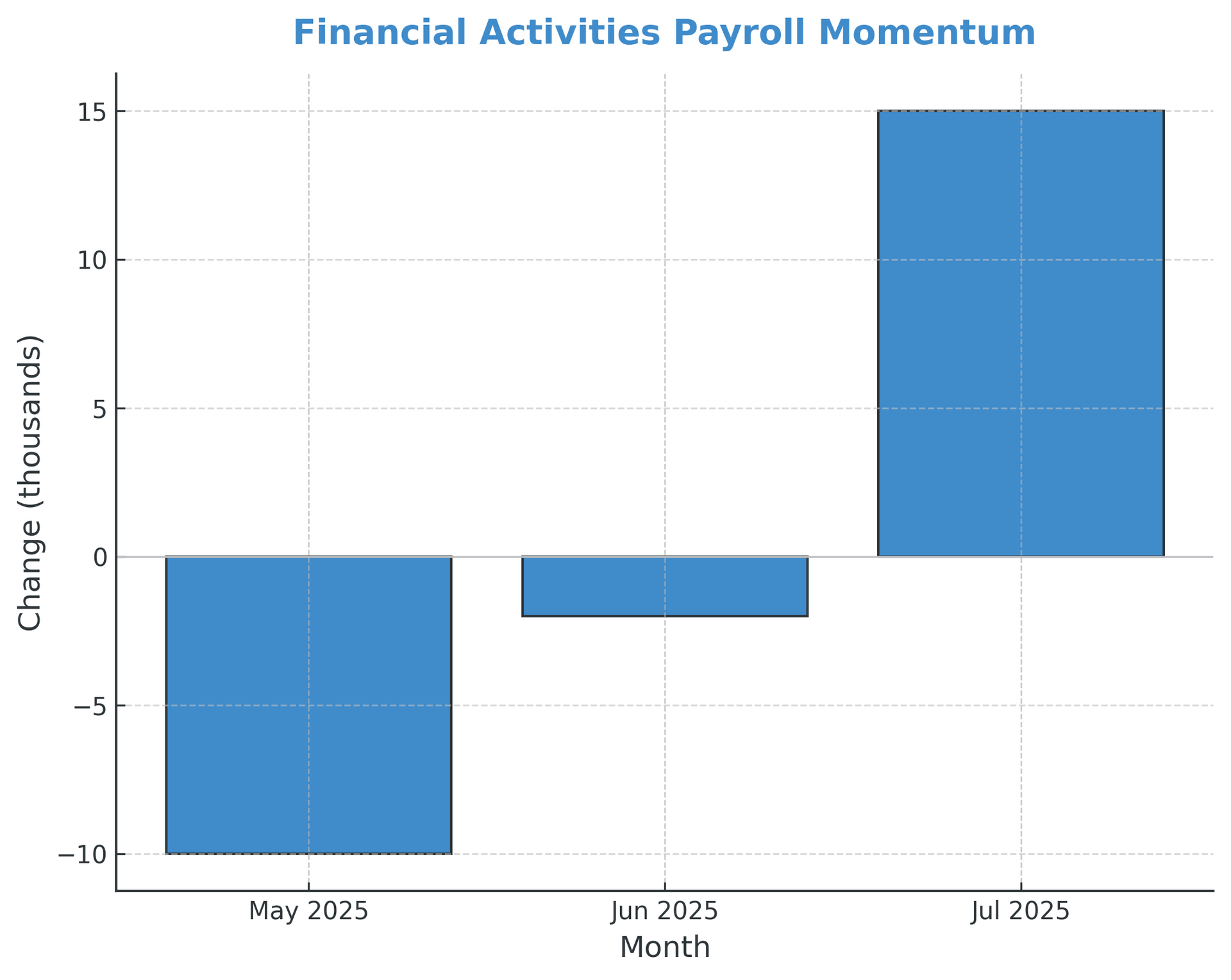

- Momentum Recovered: The sector bounced back in July, contributing to nearly 1 in every 5 new U.S. jobs.

- Steady, Slower Growth: Hiring is continuing—but at one-third the pace of 2024. Growth remains positive, just more measured.

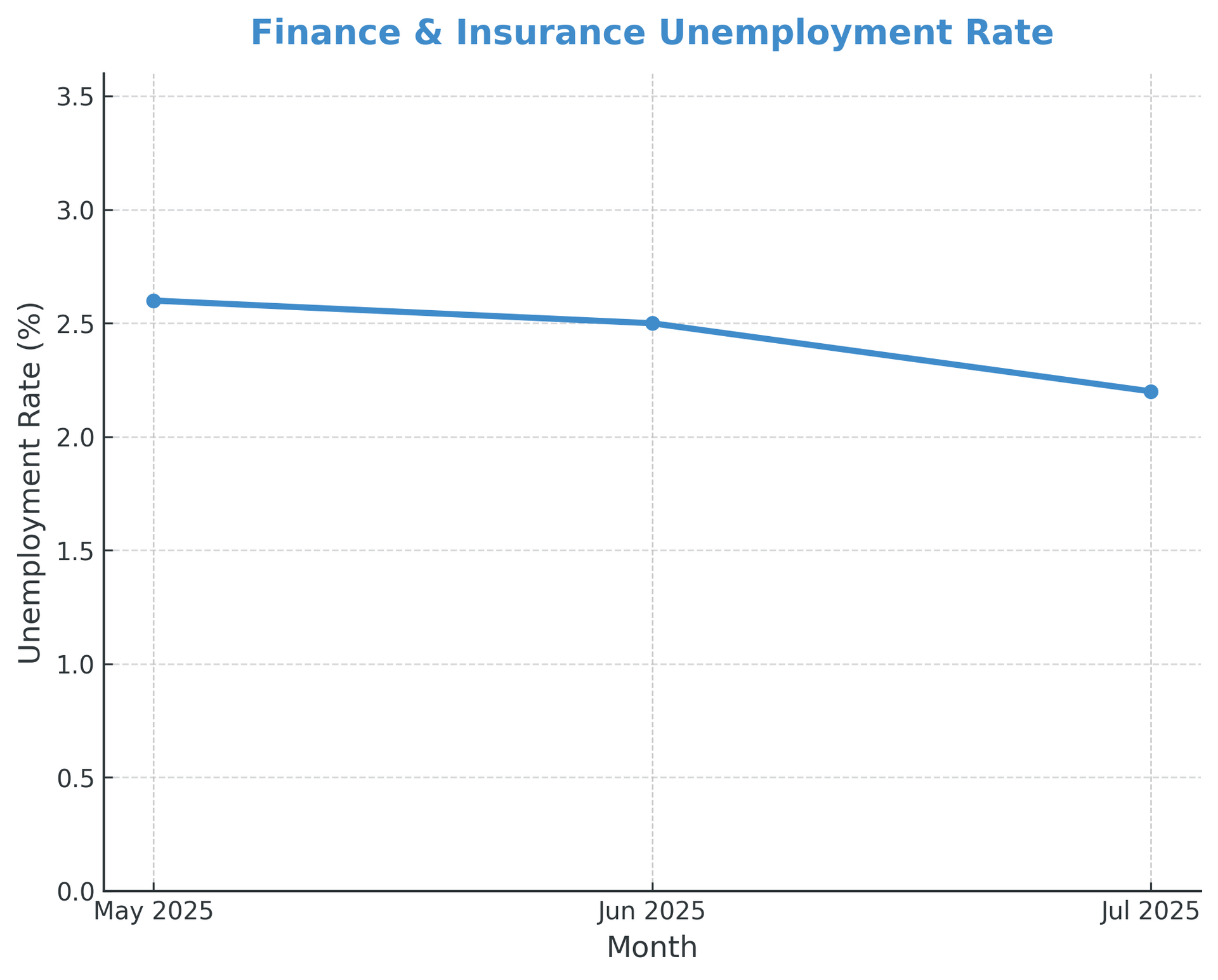

- Lowest Unemployment in the U.S.: At 2.2%, finance and insurance lead all major industries in job market tightness.

- Wages Still Climbing: Average pay rose

4.5% year-over-year, outpacing the national average of

3.9%—a sign of continued demand for specialized skills.

| Month | Payroll Change (k) | Unemployment Rate (%) |

|---|---|---|

| May 2025 | -10 | 2.6 |

| Jun 2025 | -2 | 2.5 |

| Jul 2025 | 15 | 2.2 |

What the July Jobs Report Reveals About Finance & Insurance Hiring

Finance and insurance stood out in an otherwise slow hiring month. Here's a snapshot of the key metrics—and what they mean for employers and job seekers in the sector:

- +15,000 Jobs Added (Financial Activities)

After a decline in June, the sector rebounded strongly—accounting for 1 in every 5 new U.S. jobs in July.

- 3-Month Average: +7,000 Jobs/Month

While this is a slower pace compared to 2024, it signals continued, stable growth—not a downturn.

- Unemployment Rate: 2.2%

This is the lowest unemployment rate of any major U.S. sector, down from 2.5% year-over-year. Translation: talent remains in short supply.

What’s Next for Finance & Insurance Hiring?

The outlook? Still strong—but more selective.

Firms are continuing to hire across critical functions like accounting, fiduciary services, actuarial science, tax, risk, compliance, and data analytics. But unlike last year’s rapid expansions, today’s hiring is more targeted and strategic.

While national job numbers may dominate the headlines, the finance and insurance sectors tend to follow their own rhythm. History shows they stay steady—even when broader market sentiment shifts.

Bottom line: The candidate market remains active. Employers are still hiring—but with greater precision and purpose.

What Finance Teams Should Do Now

- Speed things up. With low unemployment, top candidates move fast. Streamline your hiring process.

- Sell stability. Candidates value companies that show resilience. Talk about your balance sheet and tech investments.

- Watch the August jobs report. It's due September 5. Regardless of the headlines, the finance and insurance industries are strong and resilient.

Bottom Line

Yes, the headlines are chaotic. But finance and insurance? Still strong.

Jobs are being added. Pay is growing. And talent remains hard to find.

Hiring isn’t stalling—it’s idling, waiting for clarity.

Until then, hiring managers should plan for a more cautious, data-driven road ahead.

We make every conversation worth your time.

Let's Talk Talent

FAQ:

Finance & Insurance Hiring Trends (August 2025)

Is finance still hiring?

Yes. The sector added 15,000 jobs in July—about 20% of all new U.S. jobs.

What types of roles are in demand?

Risk, compliance, analytics, and tech-savvy positions (AI, RPA, cybersecurity) are top priorities.

How should finance teams prepare for uncertainty?

Accelerate interview cycles and emphasize your organization’s stability and growth strategy. Utilize services of firms like Lyneer Search Group who specialize in niche sectors of finance and insurance.