Mid‑Year 2025 Hiring Outlook: Accounting & Finance Talent Trends

Winning the Mid‑Year Talent Race. Secure Accounting & Finance Stars Before Q4.

Executive Summary

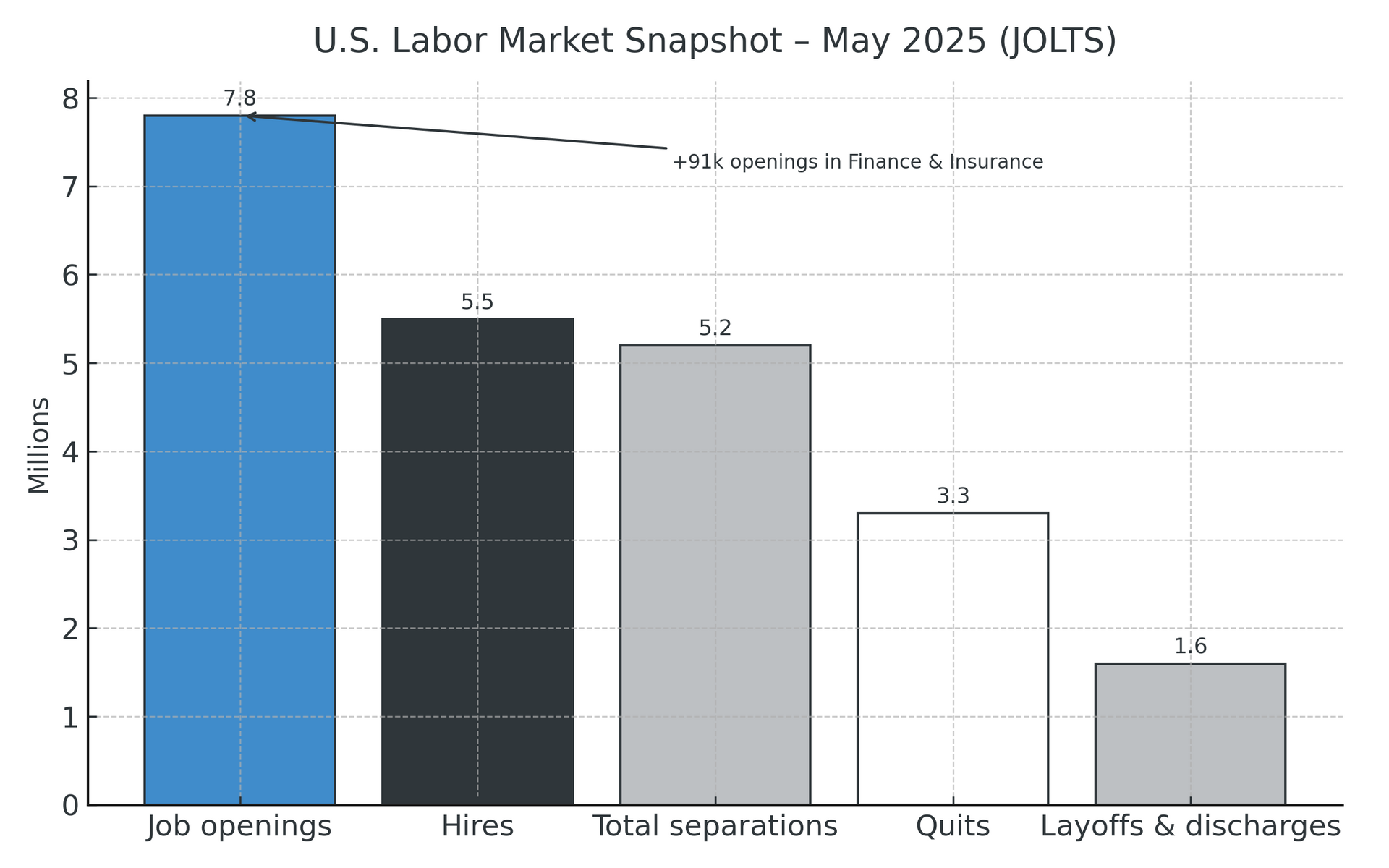

On the last business day of May 2025, U.S. job openings were 7.8 million. Vacancies jumped by 91,000 in finance & insurance, while the economy‑wide ratio of unemployed persons to job openings held at 0.9—cooler than the pandemic peak but still signaling a skills‑tight market. Hires (5.5M) and total separations (5.2M) were little changed; quits remained 3.3M and layoffs/discharges 1.6M.

(Bureau of Labor Statistics)

Employers can leverage this “balanced but tight” window to land scarce hybrid talent (AI + accounting fundamentals) at more sustainable compensation levels—if they streamline cycles and align flexibility with what candidates actually accept.

1. Demand Is Pivoting to Tech‑Enabled Finance Skills

What the BLS data says about pay signals:

- Median pay for accountants & auditors (May 2024) = $81,680; in finance & insurance specifically it’s $87,980 (~8% premium). Bureau of Labor Statistics

- Business & financial occupations overall: $80,920 median pay. Bureau of Labor Statistics

Actionable Insight: Pair AI/predictive analytics training with core GAAP/IFRS mastery. Use that upskilling as a retention lever (see Section 4).

| Skill Cluster | Employers Increasing Headcount H2 2025 (%) |

|---|---|

| Gen‑AI & Predictive Analytics | 44 |

| ESG & Sustainability Reporting | 41 |

| Cyber‑Risk Finance & Controls | 38 |

| M&A Modeling & Valuation | 36 |

| Statutory & IFRS 18 Compliance | 33 |

Actionable Insight: Invest in

upskilling current teams with AI applications, predictive analytics, and RPA tools. Candidates with dual expertise in

finance and technology command

15–20% higher salaries than peers without tech fluency.

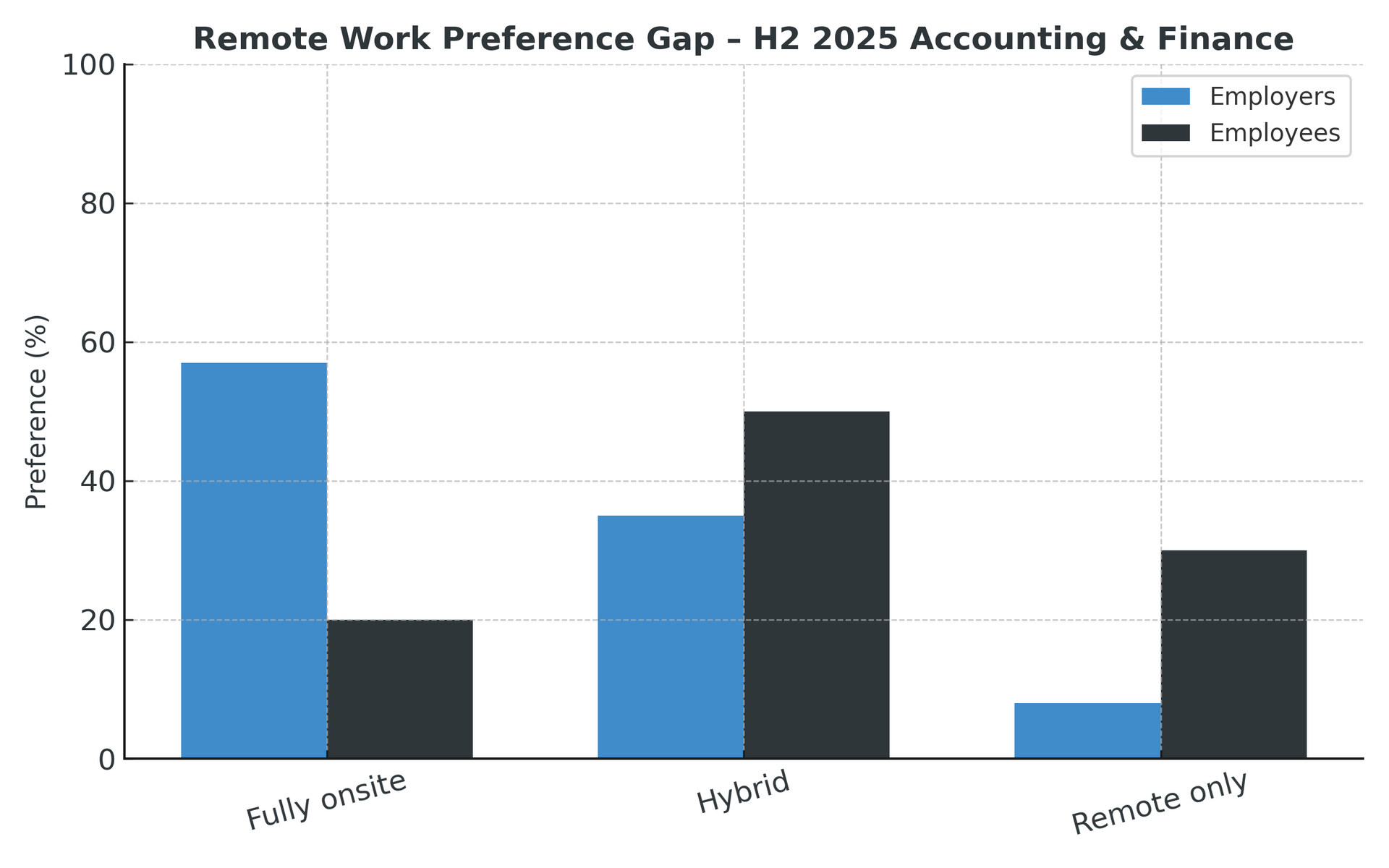

2. Hybrid Work Isn’t Dead—But the Gap Is Real

Flexibility remains a talent magnet. While 60% of employers prefer on-site work three or more days a week, 72% of candidates prioritize remote or hybrid options. This gap is a critical factor in offer acceptance rates.

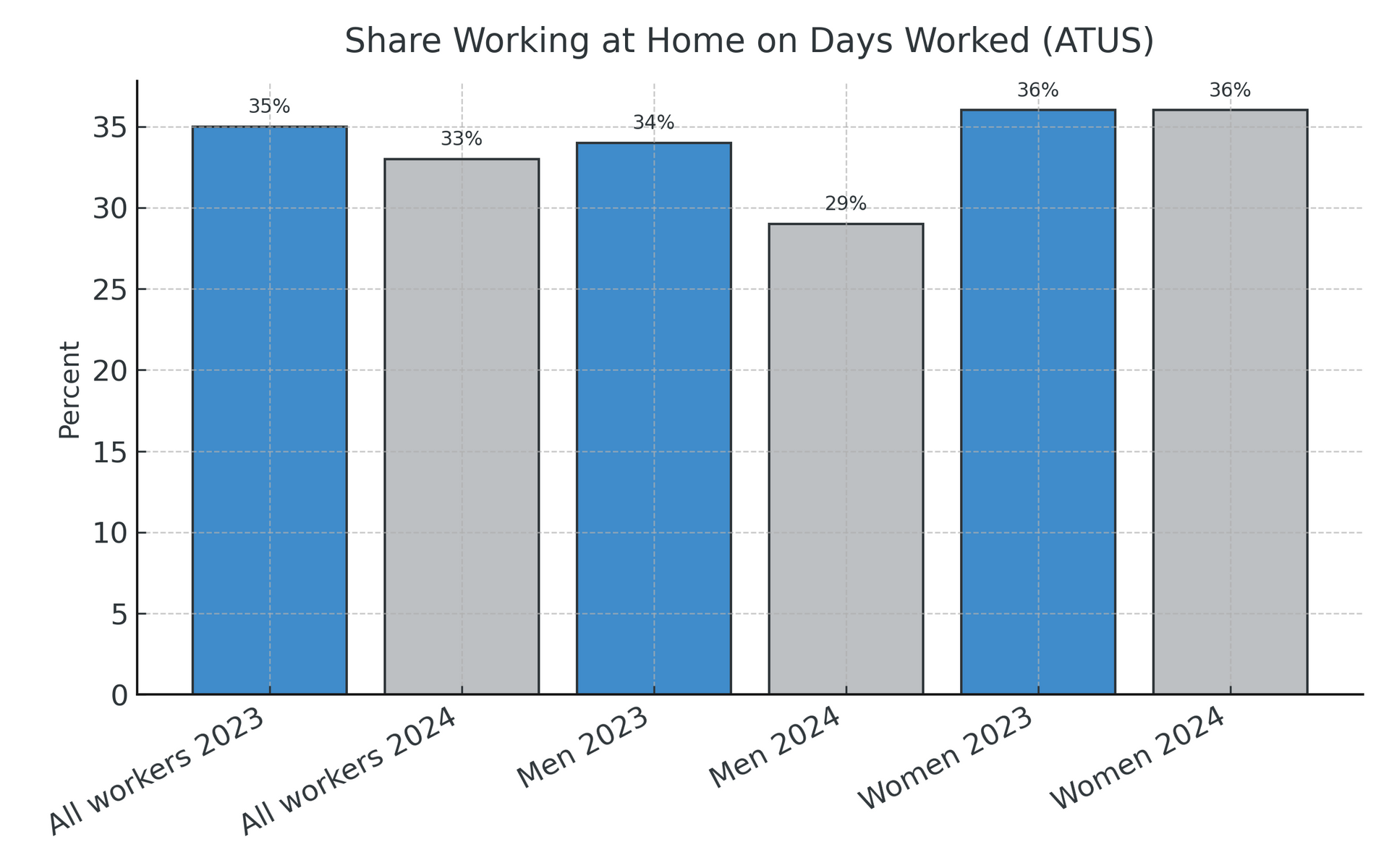

ATUS work-at-home share (2023 vs 2024, by gender)

33% of employed people worked at home on days worked in 2024 (vs. 35% in 2023). Men dropped to 29%; women held at 36%.

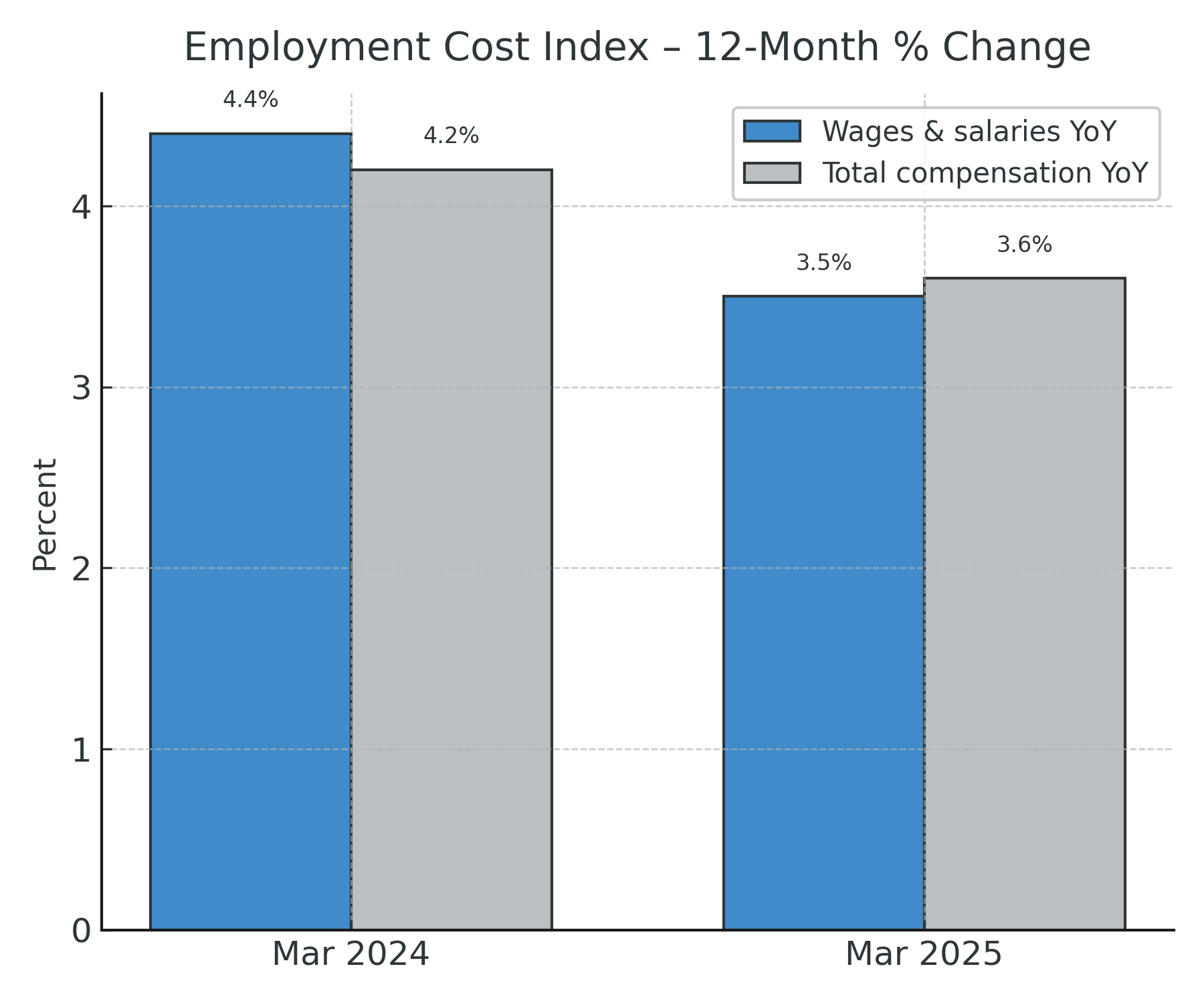

ECI 12‑month wage & total comp growth (Mar 2024 vs Mar 2025)

Q3 2025 Snapshot:

- Companies offering

full flexibility see

35% faster hiring times.

- Rigid on-site policies correlate with 25% higher turnover risk.

Actionable Insight: Offer

personalized flexibility packages (e.g., hybrid + compressed workweeks) to attract high-demand talent without sacrificing collaboration.

3. Pipeline Pressures: CPAs Down, Actuaries Up

- Accountants & auditors: +6% growth, ~130,800 openings/year (2023–33).

- Actuaries: +22% growth, ~2,200 openings/year—“much faster than average.”

- Bookkeeping, accounting & auditing clerks: projected –5% employment change but still ~175K openings/year due to retirements/turnover.

Actionable Insight: Fund CPA/actuarial exam fees and fast-track rotations. Tie bonuses to credential milestones to secure early‑career talent.

4. Pay & Retention: Growth Is Slowing, Not Stopping

- Total compensation +3.6% YoY (to March 2025); wages & salaries +3.5%, benefits +3.8%. That’s decelerating from 2024’s 4.4% wage pace.

- Retention is still employer priority #1 (53% list it as their top focus).

Actionable Insight: Replace across‑the‑board mid‑year raises with targeted retention bonuses tied to AI/ESG skill acquisition and critical project milestones.

Hiring in H2? Don’t wait for budget season to start the search.

We’ll overlay live comp data on BLS ranges and surface shortlists (via AI + network).

Book a quick call via

Calendly

| Lever | Avg. YTD Increase |

|---|---|

| Mid‑Year Salary Adjustments | +5.8% |

| Sign‑On Bonuses (Manager+) | $12.4k |

| Retention Bonuses (Director+) | 10–15% of base |

| Upskilling Stipends | $3–6k per staff |

Actionable Insight: Link retention bonuses to AI‑upskilling milestones to reduce turnover and future‑proof your workforce.

5. Recruiting Tech: Audit Your Algorithms

- 99% use AI; 93% of hiring managers still insist humans stay “in the loop.”

- Bias Amplification: Run quarterly model audits.

- Over‑Filtering: Combine AI scores with human judgment to surface high‑potential career‑switchers

- 97 % of finance organizations use AI in at least one hiring workflow (screening, skills assessments, or onboarding).

Actionable Insight: Quarterly model audits + structured human review of “borderline” candidates keeps you compliant and widens your funnel. Moreover, partnering with niche recruiters can lock in scarce talent before Q4 budgeting—often at more sustainable salary levels than those seen in early 2025.

6. Regional Hotspots to Watch

BLS OEWS data show persistent pay spreads by metro; finance hubs (NYC, Charlotte, Chicago, Phoenix, Des Moines) are still bidding hardest for actuarial analytics, treasury/ALM, and IFRS 17 reporting talent. Use local OEWS tables to calibrate offers.

Actionable Insight: When budgets are tight, source remotely from lower‑cost MSAs but keep hybrid “touchdown” options to maintain culture.

| Metro | Primary Drivers |

|---|---|

| New York, NY | M&A resurgence in specialty P&C & asset management |

| Charlotte, NC | Bank spin‑offs fueling treasury & ALM roles |

| Chicago, IL | Insurtech growth in actuarial pricing analytics |

| Phoenix, AZ | Near‑shoring finance hubs for wealth firms |

| Des Moines, IA | Life insurers staffing IFRS 17 reporting teams |

Key Hiring Strategies for H2 2025

- Flex First, Location Second – Introduce hybrid pilots or remote‑eligible functions to lower time‑to‑fill.

- Invest in Upskilling, Not Just Hiring – Sponsor AI and ESG micro‑credentials to unlock internal mobility and reduce external spend.

- Leverage Data‑Driven Forecasting – Use predictive analytics to anticipate turnover and hiring surges 3–6 months out.

- Partner with Proven Specialists – Engage niche recruiters like Lyneer to tap passive talent and market‑aligned compensation data.

What Lyneer Has that Works

- Sector Focus: Decades of success placing accounting & finance leaders in insurance, financial services, and wealth management.

- AI‑Powered Sourcing + Human Insight: Advanced algorithms surface the right talent; seasoned recruiters seal the deal.

- Real‑Time Market Intelligence: Compensation benchmarks by function, region, and AUM/NAIC tier.

Let's Talk Talent

Email hello@lyneersearch.com or book a quick call via Calendly.

Are wages still rising for accountants and finance pros?

Yes, but more slowly. Wages & salaries rose 3.5% year over year to March 2025 (ECI), down from 4.4% a year earlier. Median pay for accountants & auditors is $81,680; finance & insurance pays about $87,980.

Is hybrid work going away?

No. One‑third of workers still work at home on days worked, and 60% of employers offer hybrid options. Most also cover some home‑office costs.

Which accounting/finance roles are growing fastest (and shrinking)?

Actuaries (+22%) and many data/analytics-heavy roles are expanding. Bookkeeping/accounting clerk roles are projected to fall 5%, though turnover keeps openings high (~175K/year).

If everyone’s using AI now, why bother with a niche recruiting firm?

Because the edge isn’t the tool—it’s who’s wielding it. A specialist recruiter pairs calibrated AI search (clean, deduped, bias-audited) with a decades‑deep network of passive finance and insurance talent you won’t find in public databases. We know which skills actually move the needle (IFRS‑17, ALM, ESG reporting, actuarial analytics) and what it really takes to land those people—comp bands, flex policies, and decision timelines—so you don’t overpay or lose A‑players to faster offers. In short: AI accelerates the search; niche expertise and relationships close it.

What’s the single fastest way to cut time‑to‑fill right now?

Shorten interview loops and pre‑approve flexibility. Companies offering full flexibility report much faster hiring; ATUS/SHRM data show flexibility remains a prime lever for acceptance.

Resources

Bureau of Labor StatisticsBureau of Labor Statistics

The Washington Post