Insurance Workforce Crisis: How Transferable Skills Can Solve the Talent Shortage

The insurance industry is at a tipping point.

Talent is the make-or-break factor.

The industry is facing a workforce crisis—one that's not looming on the horizon but unfolding right now.

Insurance Industry Talent Shortage by the Numbers

- Nearly half of the workforce is over 55, nearing retirement.*

- 400,000+ insurance roles may go unfilled by the early 2030s.*

- Only 4% of millennials are considering insurance careers.**

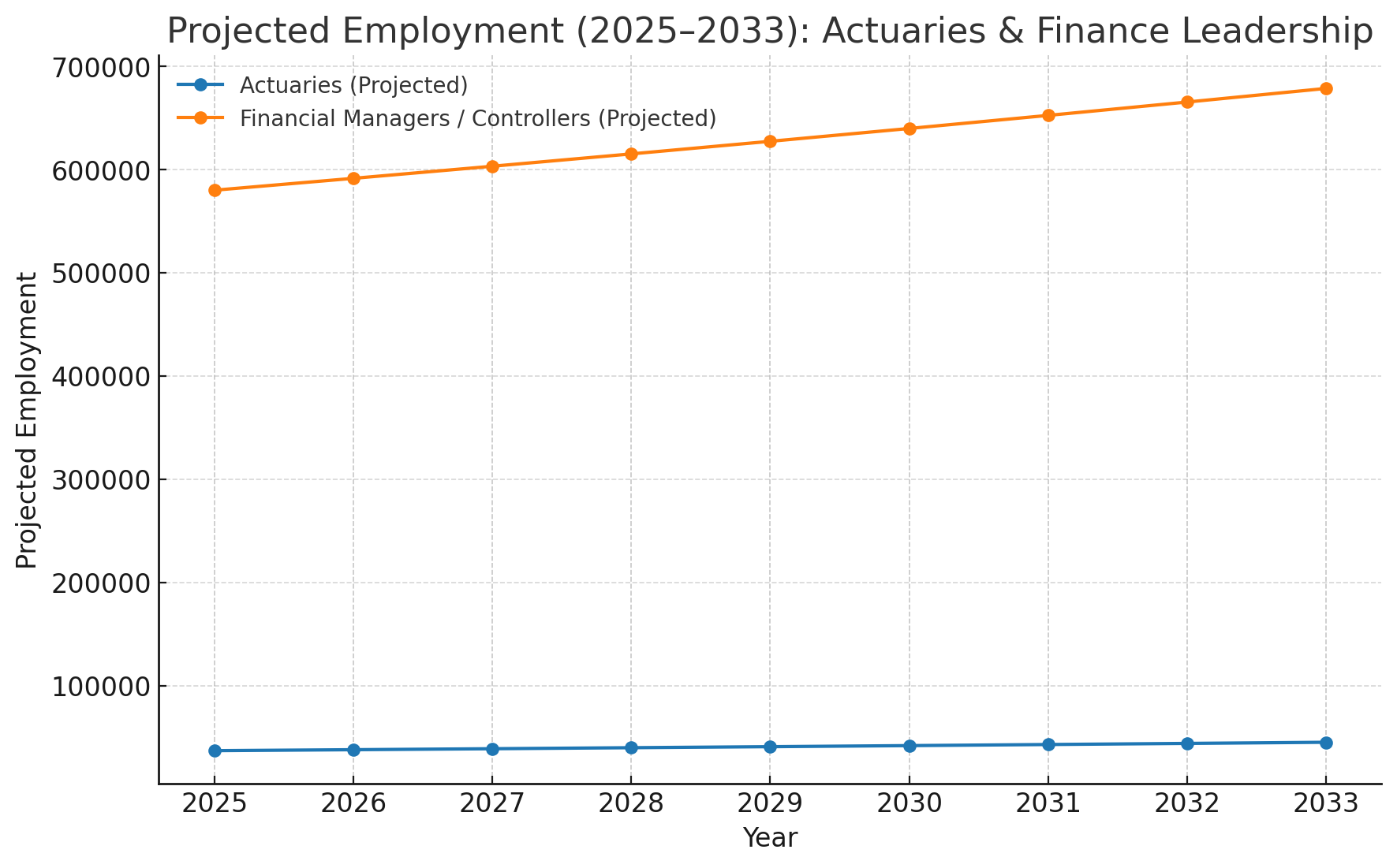

Talent shortages, an aging employee base, and lackluster appeal to younger generations have created a perfect storm. Traditional hiring practices and narrow pipelines simply can’t keep up. Moreover, projected growth for actuarial occupations are forecasted +22%, far outpacing the 4% average for all occupations.**

These numbers underscore the opportunity

and the need for

transferrable talent from adjacent sectors like

asset management and broader financial services.

The Risks of Inaction: Knowledge Drain & Innovation Stalls

The impact isn’t just future risk—it's a present threat:

- Knowledge Drain: As seasoned professionals retire, institutional memory vanishes.

- Stalled Innovation: Digital transformation demands new skill sets, but companies are slow to upskill or attract tech-savvy talent.

- Reputation Deficit: 61% of professionals say the insurance industry still projects an outdated image.

- Recruitment Breakdown: 43% of firms can’t meet candidate salary expectations, and over half of younger professionals are actively job hunting elsewhere.

The message is clear: relying on legacy recruiting methods and expecting different results is not just inefficient—it’s a liability.

Don’t risk falling behind. Explore how transferable skills can strengthen your hiring. Get in touch hello@lyneersearch.com.

Why Transferable Skills Are the Key to Closing the Gap

Insurance doesn’t have to be built only by those from insurance. Transferable skills from adjacent industries offer a rich, underutilized talent pool—one that can be tapped fast when paired with the right recruiting partner.

How to Attract Gen Z to the Insurance Industry

To build a future-ready workforce, insurers must engage the next generation. That means adapting your messaging and environments to attract Gen Z, who seek:

- Purpose – Showcase your role in climate, cyber, and community resilience.

- Flexibility – Hybrid models aren’t perks; they’re baseline.

- Growth – Career paths must be visible, with mentorships and internal mobility.

- Tech-forward culture – Cloud-based systems and AI signal innovation.

Want to learn how to reach Gen Z talent? Connect with Our Team today.

Why Lyneer Search Group Is the Right Partner

This isn’t about filling seats—it’s about

securing the future of insurance. At

Lyneer Search Group, we specialize in sourcing talent within the insurance industry for finance and accounting roles that are a perfect fit.

Here's how:

- AI-Powered Search: We rapidly connect roles with candidates who bring critical skills—even from outside the industry.

- Deep Networks: Giving you access to passive candidates who aren't found on job boards, LinkedIn and other platforms tailored only to active job hunters

- Specialized Expertise: We know how to i.dentify real transferable value, not just resume buzzwords.

- Scalable Solutions: Whether hiring one person or launching an entire team, we move with speed and precision.

“The talent crisis in insurance isn’t about a lack of people; it’s about finding the right people fast. By focusing on transferable skills and leveraging AI-driven search, we help our clients secure high-impact talent in record time.” — Scott Noga, Managing Partner, Lyneer Search Group

Futureproof Your Workforce: Take the Next Step

Don’t wait until another vacancy costs your team time, momentum, or clients.

Partnering with Lyneer Search Group ensures you don’t just fill positions–you secure the talent that will shape the future of insurance.

Start a conversation today and see how Lyneer Search Group can help you build a resilient, innovative, and future-ready workforce.

(Our team replies within 24 hours.)

Start Solving Your Talent Gap—Today

Insurance Workforce Shift – FAQ

Why is the insurance industry facing a talent shortage?

The insurance industry is facing a talent shortage because nearly half of its workforce is over 55, and more than 400,000 roles may go unfilled by the early 2030s as retirements accelerate. Without a stronger talent pipeline, insurers risk losing institutional knowledge and operational continuity.

Do all candidates need prior insurance experience?

No. A strong insurance workforce doesn’t require all candidates to have prior industry experience. Many professionals in finance, accounting, legal, and technology bring transferable skills such as risk assessment, regulatory knowledge, data analysis, and customer service that can be applied directly to insurance roles.

What transferable skills are most valuable for insurance roles?

Top transferable skills include:

- Risk assessment from finance or cybersecurity

- Regulatory compliance from legal and pharma

- Data analysis & reporting from accounting and supply chain

- Communication & client management from sales and marketing

- Problem-solving & innovation from IT and project management

- Customer service orientation from healthcare and hospitality

How can insurers attract Gen Z talent?

To attract Gen Z, insurers should:

- Highlight insurance’s purpose-driven impact (climate, cyber, community resilience)

- Offer flexible and hybrid work models (95% of professionals already work remotely in some form)

- Make career paths visible with mentorship and rotational programs

- Invest in modern technology, since Gen Z won’t stay with firms running on outdated systems

What role does AI play in solving the insurance talent gap?

AI and automation help insurers bridge staffing gaps by:

- Automating repetitive tasks like claims summaries and policy processing

- Supporting new hires with data-driven insights that reduce onboarding time

- Freeing employees to focus on higher-value work

- Enhancing retention by creating a more engaging, efficient workplace

Why partner with Lyneer Search Group for insurance recruiting?

Lyneer Search Group combines deep industry networks, AI-powered search tools, and specialized expertise in insurance, finance, and wealth management. This allows insurers to:

- Fill seats quickly with qualified talent

- Tap into adjacent industries for transferable skills

- Attract and evaluate Gen Z talent effectively

- Build future-ready workforces that can adapt to industry disruption

Sources

*US Bureau of Labor Statistics

**Chamber of Commerce’s The America Works Report: Industry