What Finance & Insurance Teams Need to Know About July’s Jobs Report

Despite political drama and softer job growth, finance hiring is holding strong—here’s what’s shifting and how to stay ahead.

The July jobs report landed with a thud.

Just 73,000 new U.S. jobs were added.

Worse—May and June’s numbers were revised down by 258,000.

Despite the drama, the finance and insurance sector came out ahead.

What Is the Finance and Insurance Sector?

The Finance and Insurance sector plays a crucial role in the economy by managing money, risk, and financial transactions. It includes businesses that:

- Move money around. These are banks and investment firms that raise funds (through deposits or issuing securities) and lend or invest those funds. This process, called financial intermediation, helps connect borrowers and lenders while managing risk and return.

- Protect against risk. Insurance companies and annuity providers collect premiums, invest reserves, and pay out claims. Their goal is to spread risk and provide financial security.

- Support the system. This includes firms offering specialized services like brokerage, financial advising, and managing employee benefits.

Even government bodies like central banks fall under this sector, thanks to their role in controlling the money supply and maintaining financial stability.

The finance and insurance sector consists of these sub-sectors:

- Monetary Authorities

- Credit Intermediation and Related Activities

- Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- Insurance Carriers and Related Activitie

- Funds, Trusts, and Other Financial Vehicles

Finance & Insurance Sector Employment Trends

- Sector regained momentum, accounting for ~1 in 5 of all U.S. job gains.

- Pace is one-third of 2024’s average—growth, but slower.

- Lowest unemployment of any major industry; talent remains scarce.

- +4.5 % Y-o-Y—pay is still climbing faster than the 3.9 % overall average.

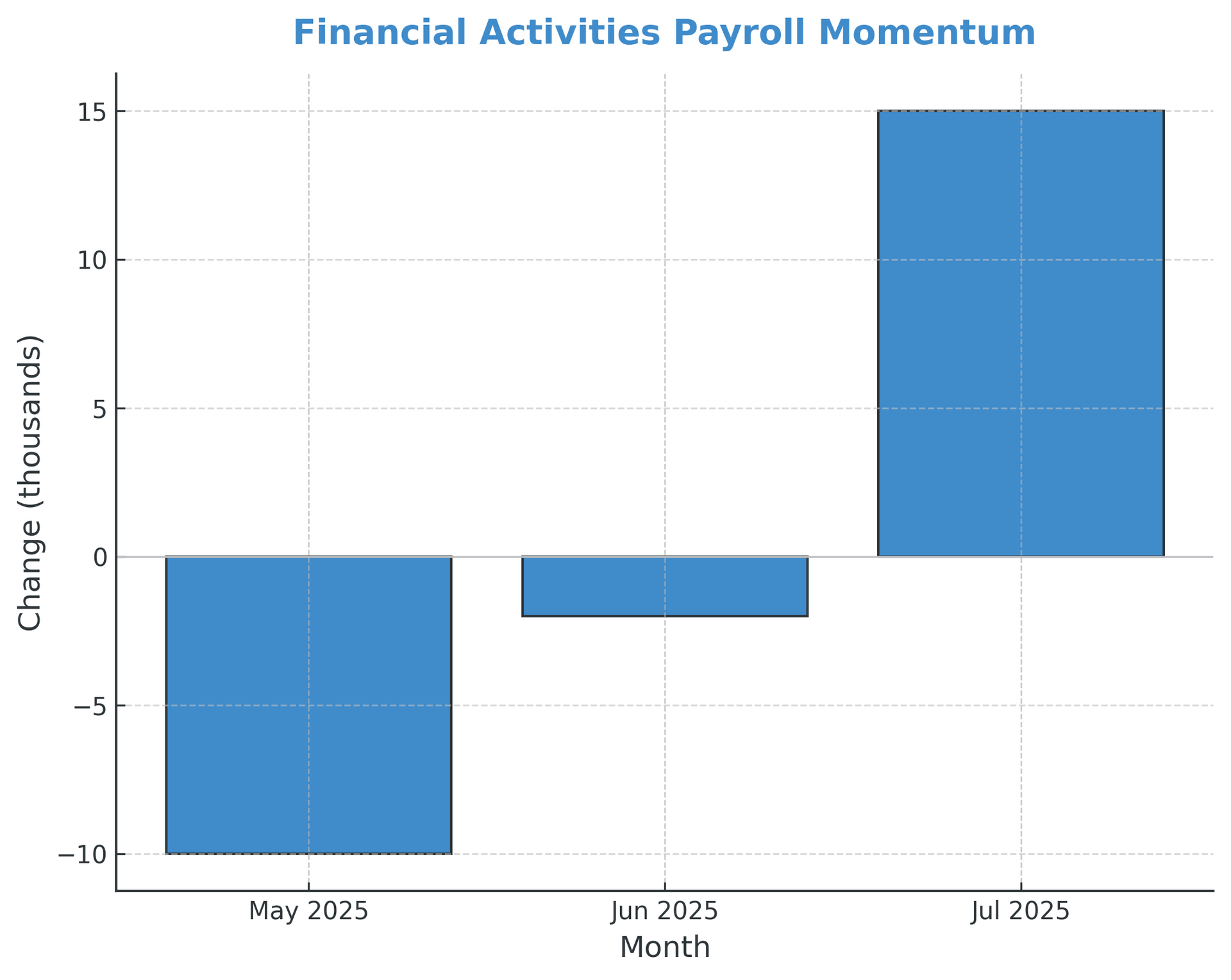

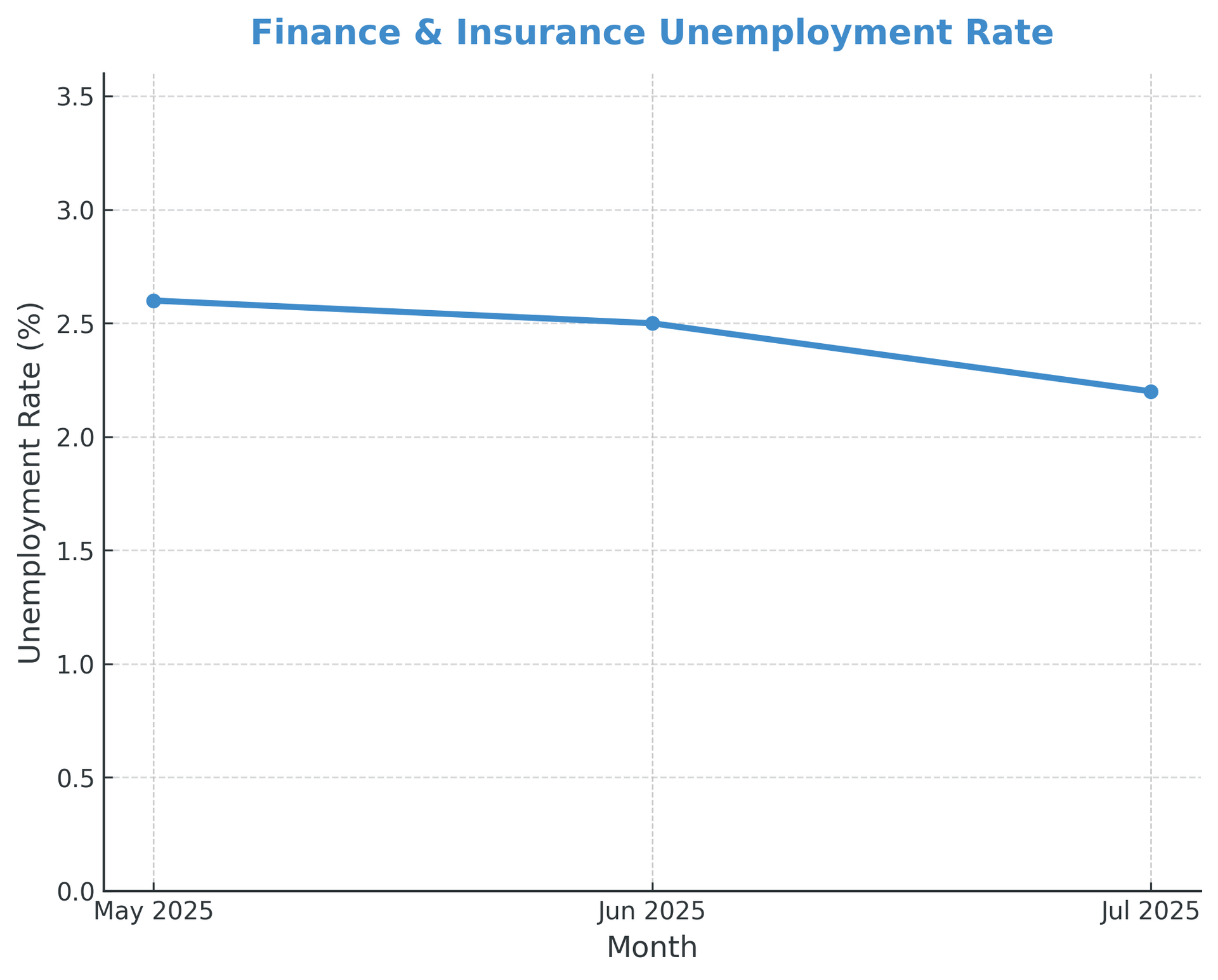

| Month | Payroll Change (k) | Unemployment Rate (%) |

|---|---|---|

| May 2025 | -10 | 2.6 |

| Jun 2025 | -2 | 2.5 |

| Jul 2025 | 15 | 2.2 |

What the July Jobs Report Says About Finance & Insurance Hiring

Here’s what you need to know:

- Payroll Change (Financial Activities)+15K jobs-Up from -2k

- Finance made up 1 in 5 new U.S. jobs

- 3-Mo Avg. Payroll Change+7K/mo

- Down from 2024

- Growth is slower, but steady

- Unemployment Rate2.2%

- Down from 2.5% YoY

- Lowest of any major sector

- Avg. Earnings

- $47.67+4.5% YoY

- Pay is rising faster than U.S. average (3.9%)

What’s Coming Next? (Near-Term Hiring Outlook)

Hiring is cautious, but still happening.

Firms are filling accounting, fiduciary, actuarial, tax, risk, compliance, and data analytics roles—just more selectively than last year.

The jobs report will continue to spark debate; however, the finance and insurance sectors will follow tradition and drive a healthy candidate market.

What Finance Teams Should Do Now

- Speed things up. With low unemployment, top candidates move fast. Streamline your hiring process.

- Sell stability. Candidates value companies that show resilience. Talk about your balance sheet and tech investments.

- Watch the August jobs report. It's due September 5. Regardless of the headlines, the finance and insurance industries are strong and resilient.

Bottom Line

Yes, the headlines are chaotic. But finance and insurance? Still strong.

Jobs are being added. Pay is growing. And talent remains hard to find.

Hiring isn’t stalling—it’s idling, waiting for clarity.

Until then, hiring managers should plan for a more cautious, data-driven road ahead.

We make every conversation worth your time.

Let's Talk Talent

FAQ:

Finance & Insurance Hiring Trends (August 2025)

Why did the President fire the BLS Commissioner?

The President claimed the jobs numbers were inaccurate and “rigged,” prompting the firing. Experts are concerned this could damage trust in federal labor data.

Is finance still hiring?

Yes. The sector added 15,000 jobs in July—about 20% of all new U.S. jobs.

What types of roles are in demand?

Risk, compliance, analytics, and tech-savvy positions (AI, RPA, cybersecurity) are top priorities.

Will pay continue to rise?

Most likely. July’s average hourly wage in finance was $47.67—a 4.5% increase year over year.

How should finance teams prepare for uncertainty?

Accelerate interview cycles and emphasize your organization’s stability and growth strategy.